Fund 11 is our very first CashGrowth+™ Fund, which focuses on boosting year-1 cash flow while also maximizing long-term equity growth during changing market cycles.

Open Door Capital’s newest mixed-asset fund, which includes mobile home communities, self storage facilities, and private credit, is the most investor friendly (and diversified) fund ODC has ever launched.

- For the First Time Ever: We’re offering a Platinum Share class with 85% LP / 15% GP splits above the 8% preferred return (limited availability).

- Reintroducing: Holding Interest of up to 3.5% that you’ll earn until the fund is fully deployed.

- Goal of Fund 11: Purchase 4-7 mobile home communities and/or self storage facilities and hold for 5-10 years + a minority debt fund allocation to boost year-1 cash flow.

- Exit Strategy: Exit after adding significant value, primarily through increasing occupancy, improving management, back-billing utilities, and increasing rents.

We believe mobile home communities and self storage facilities are the best asset classes during this part of the market cycle, providing strong, recession resilient cash flow.

Previous Offerings

Fund 1

June 2019

Exited mobile home community fund across multiple markets

28 Months

Hold Time

35%+*

Exit IRR

1.7X

Equity Multiple

Fund 2

Early 2020

CashGrowth™ mobile home community fund across multiple markets

651

Total Units

15-22%*

Projected AAR

7%*

Projected Avg

CoC

Fund 3

October 2020

CashGrowth™ mobile home community fund across multiple markets

1,099

Total Units

15-22%*

Projected AAR

8-12%*

Projected Avg

CoC

Fund 4

June 2021

CashGrowth™ mobile home community fund across multiple markets

645

Total Units

14-20%*

Projected AAR

8-10%*

Projected Avg

CoC

Vail Valley Portfolio

July 2021

Three apartment complexes located in Eagle County, Colorado

139

Total Units

17-21%*

Projected AAR

7-8%*

Projected Avg

CoC

The Point at Cypress Woods

July 2021

Class B apartment complex in Houston

530

Total Units

15-19%*

Projected AAR

8.5-9.5%*

Projected Avg

CoC

Fund 5

October 2021

CashGrowth™ mobile home community fund across multiple markets

434

Total Units

14-20%*

Projected AAR

7-10%*

Projected Avg

CoC

Fund 6

March 2022

CashGrowth™ mobile home community fund across multiple markets

1,245

Total Units

12-15%*

Projected AAR

7-10%*

Projected Avg

CoC

Heights on Katy

October 2021

Class A apartment complex in a prime submarket of Houston

387

Total Units

13-18%*

Projected AAR

7-9%*

Projected Avg

CoC

Sunbelt Diversified Portfolio

May 2022

Three apartment complexes located in Austin, Atlanta, and Daytona

508

Total Units

13-18%*

Projected AAR

7-9%*

Projected Avg

CoC

Array Apartments

June 2022

Single apartment complex located in Austin, Texas

369

Total Units

17-22%*

Projected AAR

7-9%*

Projected Avg

CoC

Lone Star Diversified Portfolio

August 2022

Two apartment complexes located in Houston and Dallas-Fort Worth MSAs

617

Total Units

15-20%*

Projected AAR

7-9%*

Projected Avg

CoC

Generational Wealth Fund

November 2022

Open Door Capital’s 7th Mobile Home Community Fund

453

Total Units

100% <5 Yrs

Targeted Return

of Capital

4-6%

Projected Avg

CoC

Hollister Place Apartments

December 2022 Generational Wealth Opportunity with single apartment complex in Houston, TX

260

Total Units

100% <5 Yrs

Targeted Return

of Capital

4-6%

Projected Avg

CoC

Fund 8

February 2023

Open Door Capital’s 8th Mobile Home Community Fund

10-20 Yrs

Hold Time

100% <5 Yrs

Targeted Return of Capital

4-6%

Projected Avg

CoC

Track Record

2,000+

Investors

13,000

Units

$982M+

Assets Under Management

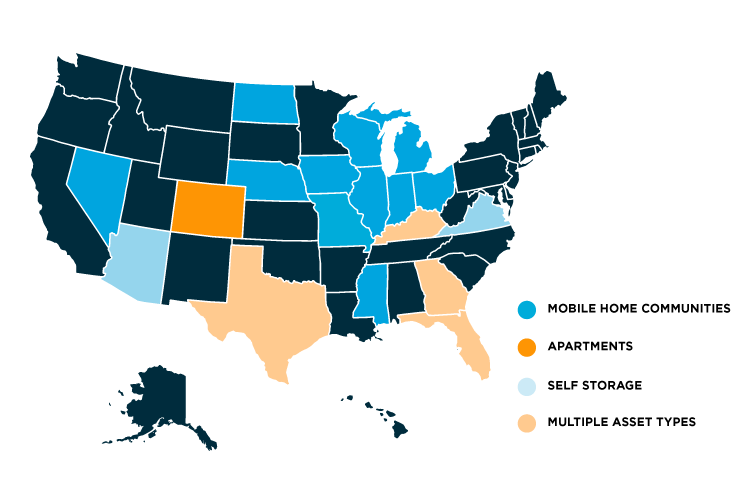

Where We Invest

FAQs

What is Open Door Capital and how does it work?

Open Door Capital is a private, well-capitalized, real estate investment firm founded by Brandon Turner. We help clients achieve superior risk-adjusted returns through the acquisition of mobile home communities, apartment complexes and self storage facilities nationwide. Open Door Capital is financed by accredited investors seeking a combination of strong cash flow and equity growth. We purchase mobile home communities and apartment complexes with a very specific set of criteria – manage them effectively and efficiently – and distribute cash flow to investors.

Can I invest with my self-directed IRA or other retirement account?

Yes! We can process investments through a variety of self-directed retirement accounts.

Can Open Door Capital accept 1031 proceeds?

Depending on the offering, we may be able to accept 1031 exchange funds, but typically only for $1M+ investments given the added complexity and legal expense associated with structuring a deal in this way. Please reach out to our Investor Relations team (investors@odcfund.com) if you have further interest.

Who is eligible to invest with Open Door Capital?

Currently, our offerings are 506c which require you to be an Accredited Investor. Click here for more information about what it takes to become an Accredited Investor.

What tax documents should I expect to receive?

K-1s will be uploaded to your profile in the investor portal, where they are conveniently available for download. Our goal is to deliver K-1s on, or before, the deadline of 3/15 each year.

What am I investing in?

Open Door Capital offers investors the opportunity to invest in single asset offerings and diversified funds which include mobile home communities, apartment complexes and self storage facilities. When you buy shares in one of our offerings, you become a direct equity owner of the LLC that owns the properties.

How will investor reporting work?

Investors will receive access to their investor portal where they can review their investment details and relevant documents at any time. Investors will also receive monthly update emails with high level financial overview benchmarked against our performance targets along with detailed, property specific updates.

Am I investing in a Fund or a Project Specific Syndication?

Open Door Capital offers both funds and project specific syndications based on the asset and your goals as an investor. Each raise will specify both the asset type and the investment type to ensure you are well informed about the investment you are making.

Does any depreciation or losses get passed through to the investor?

Yes! We typically perform cost segregation studies on all of our assets, allowing investors to benefit from bonus and accelerated deprecation.

What are the tax implications of investing in real estate syndications like Open Door Capital?

Real estate investments and syndications offer a number of tax advantages. To fully cover these implications, Brandon Turner interviewed Amanda Han and Matt MacFarland from Keystone CPA. Amanda and Matt specialize in tax strategies for real estate investors. You can watch the full interview here.

What are the tax implications of investing in real estate syndications like Open Door Capital?

Real estate investments and syndications offer a number of tax advantages. To fully cover these implications, Brandon Turner interviewed Amanda Han and Matt MacFarland from Keystone CPA. Amanda and Matt specialize in tax strategies for real estate investors. You can watch the full interview here.