Investors

Passive Income For Accredited Investors

2,000+

13,000+

Units

$982M+

Assets Under Management

Past Offerings

Fund 1 (held from June 2019 to October 2021) is a testament to our strategic investment approach. With a 35%+ LP IRR1 , nearly doubling our targeted returns, this fund exemplifies our commitment to generating substantial value for investors. Initially acquired for $6.7 million, the fund ultimately sold for $13.35 million.

Fund 1

June 2019

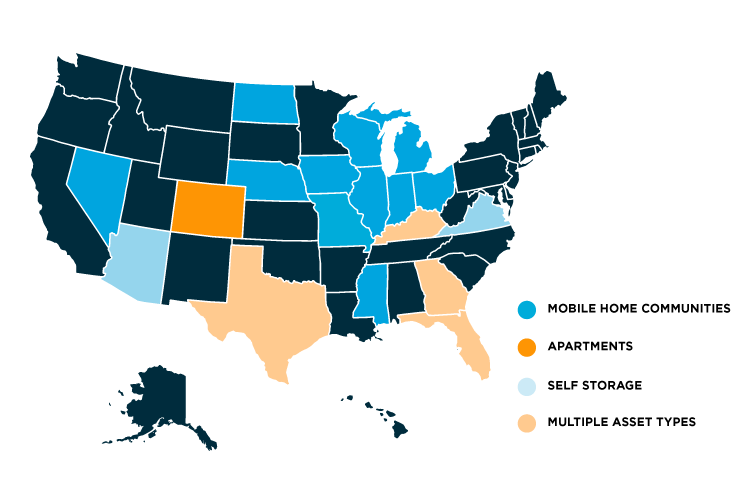

Exited mobile home community fund across multiple markets

28 Months

Hold Time

35%+*

Exit IRR

1.7X

Equity Multiple

Fund 2

Early 2020

CashGrowth™ mobile home community fund across multiple markets

651

Total Units

15-22%*

Projected AAR

7%*

Projected Avg

CoC

Fund 3

October 2020

CashGrowth™ mobile home community fund across multiple markets

1,099

Total Units

15-22%*

Projected AAR

8-12%*

Projected Avg

CoC

Fund 4

June 2021

CashGrowth™ mobile home community fund across multiple markets

645

Total Units

14-20%*

Projected AAR

8-10%*

Projected Avg

CoC

Vail Valley Portfolio

July 2021

Three apartment complexes located in Eagle County, Colorado

139

Total Units

17-21%*

Projected AAR

7-8%*

Projected Avg

CoC

The Point at Cypress Woods

July 2021

Class B apartment complex in Houston

530

Total Units

15-19%*

Projected AAR

8.5-9.5%*

Projected Avg

CoC

Fund 5

October 2021

CashGrowth™ mobile home community fund across multiple markets

434

Total Units

14-20%*

Projected AAR

7-10%*

Projected Avg

CoC

Fund 6

March 2022

CashGrowth™ mobile home community fund across multiple markets

1,245

Total Units

12-15%*

Projected AAR

7-10%*

Projected Avg

CoC

Heights on Katy

October 2021

Class A apartment complex in a prime submarket of Houston

387

Total Units

13-18%*

Projected AAR

7-9%*

Projected Avg

CoC

Sunbelt Diversified Portfolio

May 2022

Three apartment complexes located in Austin, Atlanta, and Daytona

508

Total Units

13-18%*

Projected AAR

7-9%*

Projected Avg

CoC

Array Apartments

June 2022

Single apartment complex located in Austin, Texas

369

Total Units

17-22%*

Projected AAR

7-9%*

Projected Avg

CoC

Lone Star Diversified Portfolio

August 2022

Two apartment complexes located in Houston and Dallas-Fort Worth MSAs

617

Total Units

15-20%*

Projected AAR

7-9%*

Projected Avg

CoC

Generational Wealth Fund

November 2022

Open Door Capital’s 7th Mobile Home Community Fund

453

Total Units

100% <5 Yrs

Targeted Return

of Capital

4-6%

Projected Avg

CoC

Hollister Place Apartments

December 2022 Generational Wealth Opportunity with single apartment complex in Houston, TX

260

Total Units

100% <5 Yrs

Targeted Return

of Capital

4-6%

Projected Avg

CoC

Fund 8

February 2023

Open Door Capital’s 8th Mobile Home Community Fund